What Is Standby Cash

Standby Cash is a line of credit that could be available to you right now. Log into your Huntington account online or in the mobile app to see if you qualify. You could access between $100 and $1,000 in just a few clicks. And its free when you set up automatic payments, otherwise a 1% monthly interest charge applies to your outstanding balance.

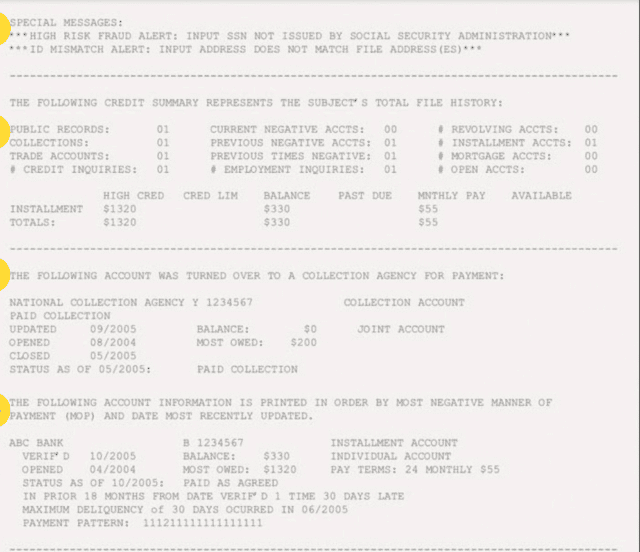

To qualify for Standby Cash, you need $1,000 or more in monthly deposits to a Huntington personal checking account for three consecutive months, and an average daily balance of $200 or more in your checking account. Other eligibility requirements apply, including your recent overdraft and/or return history. With Standby Cash, your credit score does not impact your access and once you’re approved with a few clicks online it is available for immediate use. Once you open Standby Cash, the account and your activity are reported to credit reporting agencies, so your use could positively or negatively affect your credit score.

While Standby Cash is not overdraft protection, Huntington customers can leverage it to avoid an overdraft or return transaction. If you believe you are going to overdraw your account, you can use Standby Cash and make a transfer to prevent the overdraft from occurring. If you had an overdraft for more than 24 hours, you become ineligible to use Standby Cash until your account is no longer negative. So, make sure to keep an eye on your finances and avoid overdraft and return transactions.

Buying The House You Want

The home-buying process can be very tedious and time-consuming.

Unfortunately, a low credit can make buying a home even more stressful because you could end up spending much more money than if you had a good credit score.

And if youre a numbers person, viewing this graph below will quickly show you what a good credit score and a bad credit score can do.

| $250,000 home paid over 30 years: |

Over 30 years on a $250,000 home, someone with a bad credit score could expect to pay $132,574 more just because of their bad credit.

How Your Credit Score Impacts Your Financial Future

Many people do not know about the credit scoring systemmuch less their credit scoreuntil they attempt to buy a home, take out a loan to start a business or make a major purchase. A credit score is usually a three-digit number that lenders use to help them decide whether you get a mortgage, a credit card or some other line of credit, and the interest rate you are charged for this credit. The score is a picture of you as a credit risk to the lender at the time of your application.

Each individual has his or her own credit score. If you’re married, both you and your spouse will have an individual score, and if you are co-signers on a loan, both scores will be scrutinized. The riskier you appear to the lender, the less likely you will be to get credit or, if you are approved, the more that credit will cost you. In other words, you will pay more to borrow money.

Scores range from approximately 300 to 850. When it comes to locking in an interest rate, the higher your score, the better the terms of credit you are likely to receive.

Now, you probably are wondering “Where do I stand?” To answer this question, you can request your credit score or free credit report from 322-8228 or www.annualcreditreport.com.

Because different lenders have different criteria for making a loan, where you stand depends on which credit bureau your lender turns to for credit scores.

Don’t Miss: Is 633 A Good Credit Score

How Might My Actions Affect Credit Scores

Reading time: 2 minutes

-

Its important to recognize how your financial behaviors may impact your credit scores

-

There are several factors that are used to calculate credit scores

-

There are many different credit scoring models, or ways of calculating credit scores

Regardless of the financial milestones youre reaching, when it comes to financial progress and credit, its important to understand the factors that may impact your credit scores. Consider the following:

What are some other factors that might affect credit scores?

There are several other factors that might affect credit scores, and its important to note that lenders view these factors in different ways.

Here are some examples of those factors:

- Missing payments or making late payments

- Having a past-due account transferred to a collection agency or debt buyer

- Applying for credit too frequently in a short amount of time

How Bad Credit Affects You

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

While working on your credit score may feel challenging, its an essential part of building a healthy financial future. After all, having bad credit can make it much harder to qualify for a mortgage, get a loan or even rent an apartment. Even if you do manage to access the credit you need, paying higher interest rates and having to make larger down payments can make it tough to get ahead.

Read on to learn more about what happens if you have a low credit score.

In this article, well cover

Read Also: How To Report Tradelines To Credit Bureau

Will My Credit Score Worsen If I Miss A Monthly Payment

Because of the importance of payment history, each missed student loan payment private or federal can have a significant negative impact on your credit score.

However, Black points out, your private lender or your federal servicer has to report you as late before the action affects your credit. With private lenders, that could happen when you reach the 30-day past due mark, Black explains. Federal student loan servicers, by comparison, typically dont report you as late to the credit bureaus until youre 90 days past the due date.

Even if you arent being reported, though, you could still face negative consequences from your lender or servicer in the form of late fees or penalties. These may be added to your loan balance and accrue further interest, causing your debt to grow. Thats why its important to always make your payments on time, if possible.

Late payments can stay on your credit report for up to two years, Kantrowitz says, even after you resume payments and bring your account current. However, recent activity has a bigger impact on your credit score than older activity, he adds. So there should be an improvement in your credit score even within a few months of bringing the account current and resuming payments.

You’ll Have A Tougher Time With Utilities Including The Internet

“Utility companies are allowed to charge deposits when you have a poor credit score,” Ulzheimer explains. “And I don’t know any utility companies who are going to give you an account without a background check.”

In some states, there are protections against terminating your access to public service utilities like water, electric, gas and heat .

And if you are denied access to energy utilities due to poor credit, you may be able to pay a deposit or submit a letter of guarantee which acts essentially like a guarantor or co-signer agreement if you fall behind on your bills .

And as for non-public utilities, like internet and cable, there are fewer legal protections in place to guarantee access to these services, even though the U.N. now considers access to the internet a human right.

Recommended Reading: How To Improve Credit Score To Buy A House

High Interest Rates On Credit Cards And Loans

indicate the likelihood that you will default on a credit card or loan obligation. Having a low credit means indicates you’re a riskier borrower than someone with a better credit score. Creditors and lenders make you pay for this risk by charging you a higher interest rate.

If you’re approved for credit with a bad credit score, you’ll pay more in interest over time than you would if you had better credit and a better interest rate. The more you borrow, the more you’ll pay in interest.

Trouble Renting An Apartment

If youre applying for an apartment lease, the landlord is likely to run your credit unless local laws explicitly forbid the practice. From the landlords perspective, the need for a pre-lease credit check is understandable, as applicants with lower credit scores are statistically less likely to make timely rent payments. Landlords are especially wary of applicants with patterns of late payments, delinquencies, foreclosures, and bankruptcies in their credit reports.

But if youre an applicant, this arrangement may not feel fair and it can have a major impact on where you end up living. Landlords who own well-kept, modern properties in desirable neighborhoods typically hold renters to higher credit standards because robust demand for their properties affords them the luxury of picking and choosing who they rent to. A few years ago, for example, my now-ex-landlord flatly told me that he didnt rent his best properties to anyone whose credit score came in below 640. Larger management companies are more likely to have strict standards as well.

You May Like: Does Checking Credit Score Hurt Credit

Difficulty Landing A Job

The next time you interview for a job, your potential employer may not only ask for a list of references but also permission to run a credit check. Why? For certain rolesincluding management positions and jobs that involve handling moneycompanies want to know that the person they’re hiring can be trusted when making financial decisions.

According to a 2016 CareerBuilder survey, 72% of employers said they run a background check on every new hire, and, of those, 29% run the candidate’s credit as part of the evaluation process. Letting your credit score languish may not only cost you money in the form of expensive loans. It may also limit your ability to earn money.

How To Establish Credit For Your Child

Building credit for your child will help them establish a positive credit history and empower them to borrow for big purchases later in life.

The good news is your child doesn’t have to be 18 to start building credit. Get on the path to establishing credit for your child and help them secure a strong financial future.

Don’t Miss: Is 648 A Good Credit Score

Will Adding Your Child To Your Credit Card Help Establish Her/his Credit

Adding a minor as an authorized user can help build the minor’s credit. In some cases, card issuers report to the credit bureaus the payment histories of every individual who has a card in their name cardmembers and authorized users alike. So adding your child as an authorized user can help a young person build credit: the minor gets to “piggyback” on the good credit behavior of the original cardmember.

Not every credit card company will report authorized user payment history to the credit bureaus, however, so talk to your card issuer to find out their policies.

The authorized user approach works both ways: Good credit behavior can enhance users’ credit history, while bad behavior such as missed payments can hurt it. Only add a minor as an authorized user if you can be confident you’ll make regular and on-time payments on the card.

Things That Surprisingly Won’t Affect Your Credit

There is a lot that goes onto your credit report — it’s a veritable report card on your financial life, if you will.

Your history of paying loans, whether or not you max out your credit card and how long you’ve had different accounts, plus a myriad of other details relating to your financial history are on your report and can affect your credit score and access to credit.

But there are a lot of other things that have traditionally not made their way onto your credit report, even though you might have assumed they did. Responsible practices like always paying your rent on time basically go unrecognized. On the flip side, there’s some negative information that you might think could harm your credit but actually has no bearing on it.

There’s a push right now to consider more types of information when calculating credit scores as a way to bring into the fold more people who have little to no traditional credit history. For instance, Fair Isaac Co, which calculates the FICO score that is used in some 90% of consumer lending decisions, is currently testing an alternative score that would make millions more people creditworthy.

Alternative lenders are also proliferating, which take tons more information into consideration when evaluating a potential borrower.

So what’s left out of the traditional credit score equation? Here are some of the more surprising things:

Still, your income can indirectly impact your access to credit and your credit score.

Recommended Reading: Who Can Clean Up My Credit Report

Behaviors That Hurt Your Credit Score

Was your housing rental application recently denied? Did your new cell phone provider require a hefty deposit? It might have something to do with your credit health. Like other creditors, property management companies and cell phone carriers need assurance that youll meet your financial obligations, regardless of how much money you earn. Poor credit scores often result in credit denials or require larger deposits.

So, before you submit another credit application, understand the behaviors impacting your credit score and the actions you can take to improve your credit rating.

Top 5 Credit Score Factors

While the exact criteria used by each scoring model varies, here are the most common factors that affect your credit scores.

Recommended Reading: How Many Years Does Collections Stay On Credit Report

The Possible Costs Of A Bad Credit Score

Your credit score and, by extension, your overall credit profile dont just affect your personal finances. Your credit influences many aspects of your personal and public life, including plenty that dont involve borrowing.

This list covers seven well-known and not-so-well-known consequences of bad credit, such as difficulty getting approved for a loan, higher rates and terms on approved loans, costlier insurance, and difficulty qualifying for a traditional cellphone contract.

Security Deposits For Utilities

Your utility providers take your credit report, and particularly your payment history, into consideration when setting up your account. If you have a poor payment history, chances are you will have to provide the utility company with a deposit in order to get service.

Although the FTC outlines that any utility companies requiring deposits must require them for all new customers or none, many providers waive deposits as long as you meet their credit criteria. This means that the poorer your credit, the more likely you are to be charged a deposit when setting up an account. Some utility providers may also accept a letter of guarantee, which is a letter from someone who has agreed to pay your bill on your behalf if you cant make the payment.

Don’t Miss: Is 540 A Good Credit Score

It Doesnt Make It Easier Thats For Sure

How does bankruptcy affect you and your credit? For starters, it can impact your more severely than any other single financial event. While not all bankruptcies actually cause a big drop in your scorein fact, it is theoretically possible that your credit score could rise following a bankruptcyany negative effect makes it more challenging to acquire credit in the future.

Filing for bankruptcy affects you in another way by appearing on your for years afterward, providing a big warning sign to potential lenders about a troubled payment history. Some creditors immediately deny an application when a bankruptcy is listed on a credit report.

What Is A Credit Card

A credit card is essentially a means of borrowing money that is accompanied by interest and sometimes fees. It is also a revolving line of credit, meaning you can repeatedly borrow money on one account up to a set limit. Before applying for a credit card, you should first consider the advantages and disadvantages of using one.

You May Like: Does Removing An Authorized User Hurt Their Credit Score

You’re Too Big Of A Risk For Mainstream Lenders

Since banks like Citi, Bank of America and Discover have rigorous standards for determining who qualifies for lending, you might not qualify for traditional loans or credit cards when you have a bad credit score.

“The practical effect of having a poor is that your access to mainstream funding is limited or nonexistent,” Ulzheimer tells CNBC Select.

But before you seek lending from less-than reputable sources like payday loans, pawn shops and title loan companies, Ulzheimer stresses the importance of reading the fine print.

Payday loans, for example, are an easy way to get fast cash if you’re in a bind, but they come with disclosures stating that the APR can be as high as 400% to 700%. These should be avoided if at all possible, explains Ulzheimer.

“If you’ve got a choice between a $10,000 personal loan from Wells Fargo or a loan from’Joe’s title loan,’ reading the disclosures and agreements will make it very obvious that the mainstream lender will give you a better deal that’s just mathematics,” he says.