The Bottom Line About Building Credit Fast

When youre working to fix your credit, it takes good behavior over time. However, lowering your utilization rate by paying down existing debt, getting a new credit card or requesting a credit line increase on an existing card can provide the quickest credit score boost.

Any late payments and debts sent to collection should be handled promptly otherwise, theyll just cause more pain once they hit your credit reports. Its also wise to review your credit reports on a regular basis. in order to spot errors that might be dragging down your credit score.

Knowing what actions to take that can help improve your credit score and being a responsible borrower can boost your chances of increasing your credit score by 100 points or even more.

Does Your Credit Score Update Every Month

Your credit score probably will update every month, since creditors could be reporting as often as every 30 days.

If you use more than one form of credit â for example, student loan plus credit card plus mortgage â then youâll likely have information reported each month. As noted, any time new information is received â a credit card bill paid, a car loan approved â the credit reporting bureaus recalculate your score.

How often is your credit score updated? Could it be updated daily? Possibly, if creditors send new information every single day of the month. For most consumers, thatâs unlikely.

Donât Miss: What Credit Report Do Lenders Use

What Factors Affect An Experian Business Credit Report

A credit score contains score factors that explain how items on your credit report affect your credit score. Each credit reporting agency calculates business credit scores differently by using its own unique methodology. According to Experian, your business credit score is based on:

- Number of trade accounts, balances outstanding, payment history, cash flow, credit utilization, and trends over time.

- Public Records How recent and frequent your liens, judgments, and bankruptcies with the amount of money involved are.

- Demographic Information Years registered, Standard Industrial Classification code, North American Industry Classification System code, and size of business.

There are a few more factors according to Experian:

- The number of lines of business credit you have applied for in the last nine months.

- The number of lines of business credit opened in the last six months, as well as the number of lines of business credit used.

- Number of collections or tax liens in the past seven years.

You May Like: Does Running Credit Check Lower Score

Are You And The Prospective Lender Looking At The Same Score

Thereâs likely been a time youâve gone to check your credit score in one place, to later be surprised when the lender pulls a different credit score in deciding your approval for new credit. In addition to you and the lender possibly looking at different credit scoring models, you both may also be looking at different credit scoring versions within each model.

The two main credit scoring models lenders use are FICO® Score and VantageScore®, both which typically range from 300 to 850. Both scoring models are calculated using your payment history, your amounts owed , your length of credit history, your credit application frequency and your credit mix. Both models also have different versions, such as FICO Score 8 versus FICO Score 3 or VantageScore 3.0 versus VantageScore 4.0, for example. There can be different scores for different types of lending, such as mortgage versus auto loans, as well.

âThere are literally hundreds of different credit scores,âRod Griffin, senior director of public education and advocacy for Experian, tells Select. Lenders, however, are not required to let potential borrowers know what credit scores theyâll be evaluating, he adds. Before applying for credit, itâs worth asking a prospective lender to see if theyâll tell you which credit score theyâll check when deciding whether or not to approve you.

Read Also: How To Request Free Credit Report

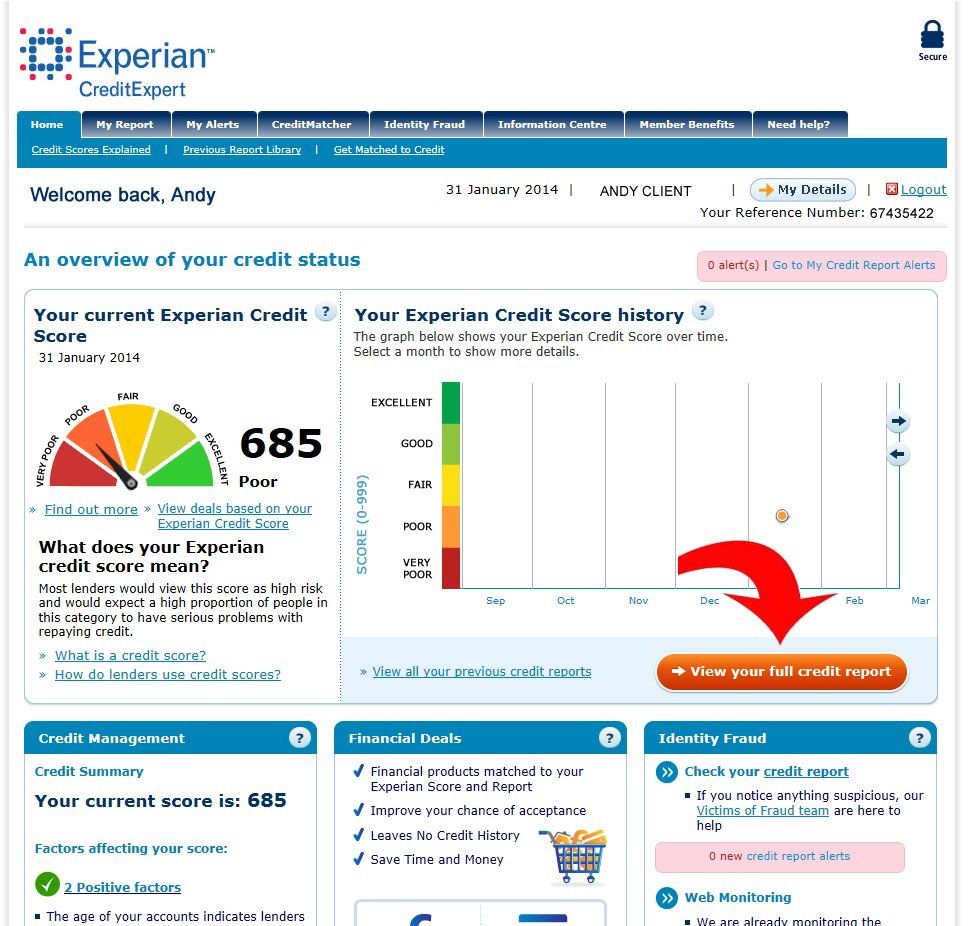

Understanding Your Experian Credit Score

Experian is a globally recognised credit information company that has its operations in multiple countries. In India, it started its operation in 2010. It is the only credit information company that licensed by Credit Information Companies Act 2005 .

As per guidelines issued by the RBI and Credit Information Companies Act of 2005, Experian provides credit score and credit report to both consumers and lenders.

Also Check: Is 778 A Good Credit Score

Other Ways To Build Credit

No matter how well Experian Boost works for you, it isn’t a complete solution for building credit or credit repair. You’re not going to go from having no credit score to having an excellent credit score just from paying your utility bills on time.

The best way to build your credit history is to use credit responsibly over time. This includes paying your credit cards and loans on time every month. You should also focus on keeping your low .

You need credit to build credit, though. If you’re struggling to get started, there are a few methods you can use.

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you\’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Also Check: What Is A Decent Credit Score

Why Do Inquiries Have An Impact On Credit Scores

The primary reason hard inquiries influence credit scores is that they indicate you may have acquired new debt that does not yet appear on your report, which raises the level of risk you pose in the eyes of lenders and credit scoring models. Usually, the impact of the inquiry diminishes rapidly in just a few months. In that time, a new account may be added, offsetting the effect of the inquiry. Or, there may be no new account, meaning the inquiry represents no new lending risk.

Additionally, multiple credit card applications within a short period of time may have a compounding effect on your perceived credit risk and start to have a noticeable effect on your scores. Lenders want to be sure you are not in danger of overextending yourself before agreeing to extend additional credit.

Thanks for asking.

So Can Experian Boost Improve Your Credit Score

Two thirds of people who sign up for Experian Boost see an increase in their score, and the average jump is 13 points, according to Griffin.

If your credit score is already at the higher end of the spectrum , any boost you see may be minimal. But for people with credit scores of 680 or lower, the average increase is 19 points.

The people who see the most impact are people who have a short credit history, a thin credit profile made up of fewer than five accounts, or scores below about 680, Griffin says. So if youre just starting out or youve had some credit issues in the past but youre moving in the right direction, thats who is benefiting the most.

If you dont see any benefits to your score initially, it is possible that Boost will help over time through a sustained positive payment history. Still, you can choose to remove Experian Boost from your credit report at any time with no negative repercussions your Experian credit score will simply revert to what it was before.

Don’t Miss: How To Check Credit Score Without Social Security Number

What Experian Boost Wont Help With

Even if a new scoring program boosts your score on paper, reaping the benefits in practice can get a little more complicated.

Each of the three credit bureaus determines your score based on the information found in your credit report with that bureau. Your lender may pull a credit score based on your report with any of these bureaus, or they may pull multiple scores based on all three reports. If your lender chooses a score based on Equifax data, for example, Experian Boost will make no difference. It only benefits your Experian score because its only added to your Experian credit report.

The score your lenders sees can also vary based on the model used to calculate the score. FICO and VantageScore, the two most common credit scoring systems, have multiple models available that lenders can choose from, and credit-boosting programs like Experian Boost wont appear on every model.

FICO 8, FICO 9, VantageScore 3.0, and VantageScore 4.0, the most commonly-used versions of each, do include Experian Boost. Credit Card issuers often use FICO 8 scores, so Experian Boost could increase your odds of getting approved for new cards. But if you were to apply for financing to buy a new car, and your auto lender uses the industry-specific FICO AutoScore to assess your creditworthiness, Experian Boost wouldnt show up or make any difference.

Where Can I Check My Credit Score

When it comes to credit scores, there are three main credit reference agencies in the United Kingdom: Experian, Equifax and TransUnion . Each uses a slightly different scoring system. But dont let that scare you. Because they all base their scores on similar criteria. So if you have one credit score, youll have a pretty good idea of how you rate with the other credit reference agencies. Heres how to access your credit score and credit history for free with the top three CRAs.

You May Like: How To Remove Freeze Off Credit Report

How Can You Get Your Experian Credit Scores

If youd still like to access your Experian credit score, you can find it for free in several places.

Experians free CreditWorks Basic service updates your credit score every 30 days. Experian also operates freecreditscore.com, another place where you get your free Experian FICO score once a month.

Some banks and credit card issuers, like Discover, also offer complimentary Experian-based FICO® credit scores.

And if youre willing to pay, Experian and FICO both offer premium services through which you can access your credit scores on a more regular basis. These services offer other benefits, too, such as access to your credit reports and credit- and identity-theft monitoring and support. But we believe strongly that you should never have to pay to access your credit scores or credit reports.

Who Should Use Experian Boost

Experian Boost is for Experian users who want to improve their credit ratings. In particular, it is for individuals that are trying to recover after a personal bankruptcy filing and individuals who initially looking for new lines of credit such as automobile financings and also credit cards.

Experian has actually created Experian Boost to assist individuals to get back on the appropriate track when it involves handling their money as well as paying expenses. This tool will offer you an understanding of what needs enhancement with your financial resources, which can be extremely valuable if you are functioning in the direction of getting out of financial obligations or accumulating a savings account.

Experian understands that sometimes life tosses some curveballs at us, so they have made certain that Experian Boost can quickly fit into any individuals timetable by being readily available anytime from anywhere as long as there is an internet network.

Don’t Miss: Do Cash Advances Hurt Your Credit Score

How Boost Affected Me

I signed up for Experian BOOST with the understanding it can only help your credit score, not hurt it. What I found was that may be true for your score but that may not be the case when applying for a loan.

Heres how it shows up on my credit report.

So heres what happened: I refinanced my mortgage, and my broker said the utilities I had reported on Boost showed up on my credit report as self-reported debts.

That created the impression that I had more monthly debt payments than I actually did. Luckily, the amount was too small to seriously affect my debt-to-income ratio. It is something you should be aware of if youre going to be applying for a mortgage or any other loan where they look at your debt or debt-to-income ratio.

Is A Fico Score Of 8 Good

FICO 8 scores range between 300 and 850. A FICO score of at least 700 is considered a good score. There are also industry-specific versions of credit scores that businesses use. For example, the FICO Bankcard Score 8 is the most widely used score when you apply for a new credit card or a credit-limit increase.

Read Also: What Credit Score Is Needed For A Home Loan

What Is Considered A Good Fico Score

A good FICO® Score starts at 670. If your score is above 740, you can generally expect lenders to offer you better-than-average interest rates. As you move closer to the top score of 850, youâll more likely qualify for the lowest interest rates and the most premium credit card offers.

On the flip side, a score of 570 to 669 is considered fair, while 300 to 569 is considered poor. You can still qualify for loans and credit cards with a lower FICO® Score, but you may be required to pay higher interest rates, make a bigger down payment or pay additional fees. Even landlords may require a credit check before they will rent you an apartment. So a lower credit score could put you at risk for securing a place.

Read Also: How To Remove A Default Judgement From Credit Report

Will Experian Boost Strengthen Your Credit Score

The average Experian Boost user sees a 12 point increase in their FICO Score 8. That figure could be higher or low, depending on your credit profile. Theres also a chance you wont see any improvement.

The good news is the service may help you, regardless of your current credit rating. If youre a credit newbie, the positive payment history reported will improve your credit health instantly. But if you have bad credit, adding these accounts to your credit profile can help reduce the impact of the negative marks you already have.

Be mindful that some lenders exclude credit information from Experian Boost when evaluating credit applications. Consequently, the credit score they see could be lower than whats reflected in the Experian portal.

Recommended Reading: Can A Creditor Remove A Negative Credit Report

What Is An Experian Business Credit Report

On the Experian Credit Information Report, or Experian CIR, you can find information such as your credit history, personal information, business information, accounts, public records, credit score, and more. The data in the Experian CIR is collected through all the banks, financial institutions, and other lenders registered with Experian. Lenders use this data to decide whether you or your business are creditworthy. Additionally, by keeping track of your credit report, you lower the chances of identity theft and fraud.

Will Credit Monitoring Hurt Your Credit Score

The short answer is no. Credit monitoring does not hurt your credit score.

According to Experian:

If consumers access their own credit reports, it does not have any effect on their credit scores. Reviewing a credit report results in what is called a soft pull, or soft inquiry, meaning it will only be seen on a personal credit report. When a consumer applies for credit, the lender will review the applicants credit report, and a hard inquiry will be added. Hard inquiries are shown to other lenders because they may represent new debt that doesnt yet show on a credit report as an account. Hard inquiries can affect credit scores. Everyone should check their reports at least annually. Its part of good credit management.

All three of the major credit reporting bureausEquifax, Experian, and TransUnionare required by law to provide consumers one free copy of their credit report every year. At AnnualCreditReport.com you can request your report from all three of the major bureaus. You can view your report online or they will mail you a copy. If you view your report online, its a good idea to print a copy of the report for reference.

Additionally, for a relatively modest fee, you can access your credit report every month and get notified any time theres a change to your credit score. This is how I monitor my personal credit score.

Don’t Miss: Does A Soft Pull Affect Credit Score

Experian Boost Incorporate With Third

Experian Boost connects with the most popular credit monitoring applications.

ClearNow

Experian Boost can churn out Experian credit history reports to ClearNow for the purpose of debt consolidation and fund applications.

WePay

Connect Experian Boost with your WePay account to make sure that the settlement history reported with Experian is visible on WePays platform.

BillGuard

Experian boost connects with BillGuard, which shows customers unpaid accounts in a straightforward method. With this integration, there are no late costs since you will certainly be notified beforehand when something requires focus.

Experian Boost connects with Credit Karma, which offers consumers the alternative to receive personalized deals from multiple banks.

Upromise

Experian boost can connect to Upromises system. This connection allows you to track and get awarded for your spending routines on charge cards while taking part in different programs used by banks like American Express or Chase Financial Institution.

Bill Me Later

Experian Boost additionally collaborates with Bill Me Later . The integration is suggested for small company proprietors who desire their suppliers to utilize this solution so they can handle every one of their accounts through one dashboard.