How To Request A Credit Limit Increase

When you ask for a credit limit increase, your card issuer might ask you to provide information surrounding your employment status, income and monthly mortgage or rent payments to determine if it should approve your request. It might also take a look at your credit report. If youre unsure about whether your card provider will carry out a hard or a soft pull, all you have to do is call and ask.

Remember that credit card providers dont shy away from increasing credit limits as long as they know that borrowers have the ability to make repayments.

-

Capital One states that requesting a credit limit increase does not lead to a hard inquiry on your credit report. You may request a Capital One credit limit increase online or over the phone. Capital One asks you for your desired credit limit, and you also need to provide details about your employment status, income and mortgage/rent payments. Depending on the information you provide, Capital One might approve your request

-

If you request a Chase credit limit increase on your own, you may expect a hard inquiry on your credit report. Chase lets you request a credit limit increase only over the phone.

-

to request a credit line increase. Depending on the specifics of your Wells Fargo credit limit increase application, it might carry out a hard or a soft credit pull. As a result, you might want to confirm this with a customer service representative in advance.

Show more

How Much Of A Credit Limit Increase Should I Ask For

Asking for a credit limit increase can be a tricky situation. You dont want to ask for too much and be declined, but you also dont want to ask for too little and not get the full benefit of the increase. A good rule of thumb is to ask for a credit limit increase that is equal to your current credit limit. This way, you have a good chance of being approved for the full amount you are requesting.

As a result of the Coronavirus pandemic, many Americans are experiencing financial difficulties. When you are approved for a credit card, your credit limit will be set by the card issuer. This amount can range from a few hundred dollars to tens of thousands of dollars. Consider the effect a higher credit limit may have on your credit score. Your credit limit can be increased automatically whenever you request it, without your consent. It is possible to make online payments by logging in to your online account or via the card issuers mobile app. Make sure you dont abuse the increased purchasing power youll receive by increasing your credit limit.

How To Increase Your Credit Limit

Your credit limit, also known as your credit line, is the maximum amount that you can spend with your credit card. If you’d like to have more available credit, it’s possible to get a credit limit increase. In addition to giving you more buying power, this can also improve your credit score. Below, you’ll find out how to increase your credit limit, as well as the pros and cons of doing so.

Jump To

Also Check: Does A Overdraft Affect Credit Rating

When Should I Ask For A Credit Limit Increase

When something positive happens : In much of life, timing is everything. In credit this is particularly true. If you want to time your request for maximum chance of success, I suggest asking for an increase if something positive has happened since you got your card. This could be anything from an increase in your household income, a decrease in your debt load or an increase in your credit score.

Conversely, I dont suggest you apply if any of the following has happened: youve lost your job or had an income cut your credit score has decreased youre at or near your credit limit you recently missed a payment or paid less than the minimum or youve recently added new credit.

When you have a strong credit background: In general, after six to 12 months of on-time payments, you may be eligible for an increase. You should make sure that those payments have been for more than the minimum required. Your current utilization on the account will also likely be taken into account in the decision, so try to keep your percentage at 30 percent or less to help increase your chances of being approved for an increase. These actions demonstrate a responsible use of the credit you already have.

Does A Credit Limit Increase Affect Your Credit Score

Home » Blog » Does a Credit Limit Increase Affect Your Credit Score?

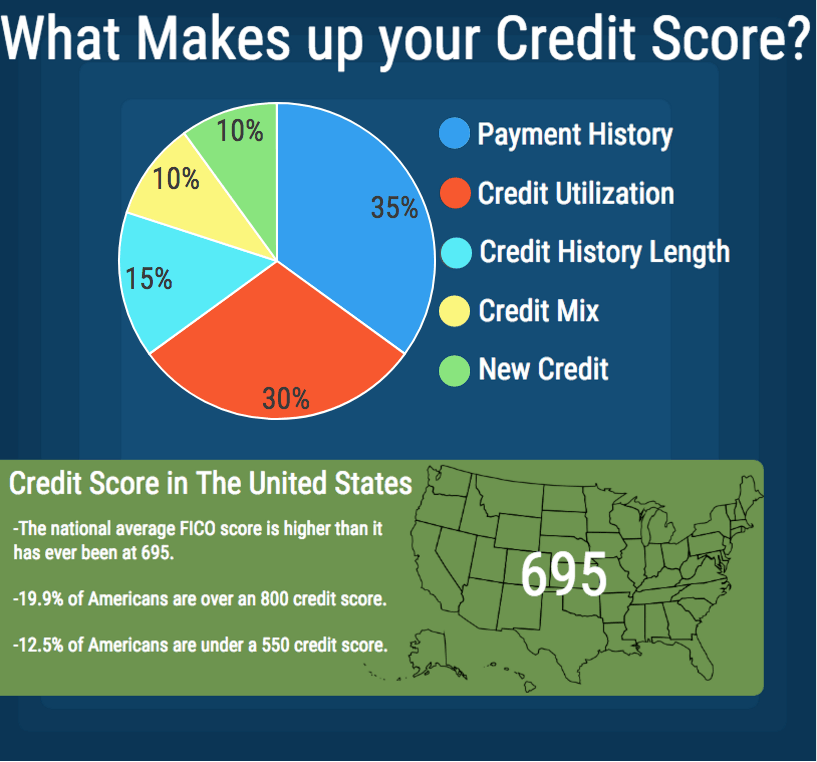

Lets explore some of the important factors about credit limits that everyone could benefit from knowing, starting with the basics. A credit limit is the maximum spending amount set by your credit card company. Its based on your credit score, along with other financial information.

A credit-limit increase raises that spending amount, allowing for larger purchases and a higher credit card balance each month. Depending on circumstances, that can be good or bad or both!

Recommended Reading: How To Increase Credit Score With Credit Card Payments

Does Increasing The Credit Limit Affect Your Credit Score

the decision to increase the credit limit can be confusing and may happen in various ways. it might be possible that you have outgrown your available credit limit and want to request more. sometimes, credit care companies themselves offer extra credit limits on your existing if you have used your credit card responsibly. but what is the impact of a credit limit increase on your ? does it increase or decrease your credit limit? let’s discuss all these points:

Lowers Your Credit Utilization

The FICO credit-scoring model will ding your credit score if the amount of credit you’ve used is close to the total amount of the credit available to you. That’s because lenders consider you to be at risk of taking on too much debt, making it more difficult for you to make future payments. Even if these risks don’t actually apply to you, that’s how the scoring model works, and your credit score can suffer as increase.

For example, if you have a $2,000 credit limit and you regularly end up with a monthly balance of around $1,800, you’re using 90% of your available credit. Raising your credit limit will reduce the percentage of funds being used, lower the credit utilization ratio, and should improve your credit score.

Also Check: How Do You Read A Credit Report

How Can I Increase My Credit Limit

There are two ways of doing this, according to CreditCards.com. The first is to wait for automatic credit card limit increases, which are often granted to responsible credit card users as frequently as every 6 or 12 months. You can increase your odds of receiving an automatic credit limit increase by paying your bills on time and using your card frequently, which generates higher fees for the issuing bank. In other words, if you dont use your card often or have missed a payment, you probably wont get an automatic credit limit increase.

The second way is to request a limit increase with your credit card bank. This is almost always done through a short online request form on your account page or a brief phone call to the issuing bank. In many cases, simply asking for a credit increase will likely get you one, particularly if you make a good income and your account is in good standing.

How A Credit Limit Increase Could Reduce Your Credit Score

If you are looking at your utilization ratios and decide to request a credit limit increase, your credit card company may check your credit score and pull your report from one or more credit bureaus.

This creates a hard pull on your credit file and can lower your credit score slightly for about a year. For most people, a will reduce your credit score by just a few points.

However, if you request multiple credit limit increases or open several accounts within the span of a few months, lenders could interpret this as a sign of increased spending or financial difficulties, which could make it harder to obtain additional credit at the best interest rates.

On the other hand, if your credit card company offers you a credit limit increase based on your past behavior of making on-time payments and keeping your credit utilization below 30%, accept it.

When a creditor issues a credit limit increase unsolicited, they arent permitted to do a hard pull on your file. Instead, this is a soft pull. You will be able to see an inquiry was made on your credit report, but it doesnt affect your credit score. This is a good time to make sure to check your credit report for errors that could further damage your credit score or prevent you from getting a credit limit increase.

Don’t Miss: How To Get A Mortgage With Poor Credit Rating

When Is The Best Time To Request A Credit Limit Increase

While a request for a credit limit increase might have a slightly negative effect on your credit score, you may want to consider asking for one in different circumstances.

-

Salary increase/pay raise

If youve received a recent hike in your salary, you may consider asking your card issuer for an increase in your cards credit limit. This is because your issuer may then look at you as someone who has the means to afford and pay for higher spending.

-

Good credit

If you have good or excellent credit, your lender is more likely to look at you as someone who is prudent when handling debt. This increases the possibility that your request will be approved.

-

Solid track record

Lenders look at how you have been managing your debt before approving your request for a credit limit increase. If youve steered clear of missed or late payments so far, it shows that you are likely to keep making your payments on time even in the future. As a result, your lender is more likely to approve your request.

-

Not applied for new credit in a while

Getting approved for a credit limit increase might make sense if you have not applied for new credit in a while, especially if youve been managing your credit well. Having applied for multiple cards and having requested multiple credit limit increases in the recent past, on the other hand, may have the opposite effect.

What Is Your Credit Utilization Rate And Why Does It Matter

Your credit utilization rate, also known as your debt-to-credit ratio, represents your total debt divided by the total credit available to you across all of your revolving accounts. Your credit utilization rate is important because it is one of several factors lenders and creditors consider when they evaluate your request for credit. In general, lenders and creditors like to see a debt-to-credit ratio of 30 percent or below.

Heres an example of how a credit utilization rate may be calculated: If you have two credit cards with a combined limit of $10,000, and you owe $2,000 on one card and $1,000 on the other for a total of $3,000, your debt-to-credit ratio is 30 percent.

However, if one of your lenders or creditors were to reduce your credit limit by $3,000 and cap your combined credit limit at $7,000, then your credit utilization rate would skyrocket to 42 percent in the previous example. Although your spending habits and total debt havent changed, this higher debt-to-credit ratio could still have a substantial impact on your credit score.

You can read more in-depth about your credit utilization rate and how its reflected in your credit scores here.

You May Like: Who Is Factual Data On My Credit Report

How To Increase Your Credit Limit Without Hurting Your Score

As noted earlier, most lenders have a mechanism for asking for an increase. This can usually be done either by phone or via the internet. Your lender will want some information from you to consider your request, whether a hard pull is done or not. This will include your current income and employment information. You can ask if a hard pull will be done and, as noted earlier, if one can be avoided at a lower increase threshold. I would suggest that you always ask for your own information.

Before you make any decisions like this, I would also suggest that you check your credit reports for yourself. You can do this for free at AnnualCreditReport.com.

Just like taking on any new credit, this is a step I always recommend be done so that you know what is in your reports. It will benefit you by allowing you the time to correct any errors you find and be sure that your credit is in tip-top shape.

Good luck!

Have a credit score question for Steve? Drop him a line at the Ask Bankrate Experts page.

When You Might Want A Credit Limit Increase

An increased credit limit can have a positive impact on your credit score, thanks to something known as credit utilization, which is basically the percentage of available credit youâre using. For example, if you have a credit limit of $10,000 with a balance of $3,000, your credit utilization would be 30 percent. But if your credit limit was bumped up to $15,000 and you kept the same balance, your credit utilization would drop to 20 percent. Many credit scoring formulas look at credit utilization as a significant factor that affects your credit score, and a lower utilization is better.

Having a higher credit limit gives you more ability to spend, which can translate into greater rewards. So if youâre financially stable and use credit cards for the convenience and the perks, having a higher credit limit can be particularly attractive, according to Bruce McClary of the National Foundation for Credit Counseling .

âYou may have reached a point where your credit history and financial behavior have earned you a top credit score, which qualifies you for credit cards that might reward you for your spending,â he says. So if you have a trip or a big home renovation in mind, as long as you can pay your bill in full and on time, using a card with a larger credit limit can help you earn extra cash back or rewards points.

Recommended Reading: Why Wont Equifax Give Me My Credit Report Online 2017

Does Asking For Credit Increase Affect Score Discover

There is no one definitive answer to this question. While some people believe that asking for credit increases can have a positive effect on ones credit score, others believe that it can actually have a negative effect. Ultimately, it is up to the individual to decide whether or not asking for credit increases is something that they want to do.

Discover will automatically raise the credit limit for eligible credit card accounts based on a review of each account every six months, which is usually six months after the account is opened. Discover has the authority to automatically raise credit limits, but they cannot be guaranteed. Discover does not have to review your account to increase it automatically. If you ask for a credit limit increase, you will almost certainly be subject to a hard inquiry, which may lower your credit score for a short period of time. When you apply for an unsecured Discover card, your application information determines whether you will begin with a $500 credit limit or one that is higher. Discover cardholders who make at least six consecutive months of on-time payments may be eligible for automatic credit limit increases. We try to offer a variety of offers at WalletHub, but our offers do not represent all financial services companies or products. It is critical to note that this advertisement is not without risk. This site allows advertisers to place a variety of offers.

Ask Yourself Why You Want A Credit Limit Increase

If youre thinking about asking for a credit limit increase on your credit card, the first step is to assess your current financial situation. Consider the pros and cons of a credit limit increase.

On the plus side, a higher credit limit may lower your credit utilization rate if you keep your balance under control, says Bruce McClary, vice president of public relations and communications at the National Foundation for Credit Counseling.

You can figure out your credit utilization rate by dividing your total credit card balances by your total credit card limits. Having a higher credit limit on one or several card accounts can help keep your utilization rate below 30%.

Then again, a higher credit limit could also lead to trouble. A higher limit may lead some to feel that there is that much more room to spend, warns McClary. Too much of a good thing can be bad, especially if you start opening more accounts with high credit limits.

As is usually the case, its best to spend responsibly and within your means. Just because a higher credit limit may allow you to charge an expensive electronic device or pay for a vacation doesnt mean that asking for a higher limit is the right option for you.

Don’t Miss: Is 628 A Good Credit Score

How To Avoid A Credit Limit Reduction

Usually what goes up must come down, or but that doesnt have to be true in the case of your credit limit. Watch out for these few instances where you may actually see your credit limit be by your lender:

- Inactivity or low credit utilization: Not using enough of your credit limit can result in a reduction.

- Elevated credit utilization: On the other side of the spectrum, using too much of your limit can put you at risk for a reduction. Balance is key.

- Late or missed payments: If you consistently dont pay on time or enough, your lender may restrict your limit.

- Drastic change in buying habits: If you suddenly start dropping thousands of dollars left and right, your lender may reduce your credit limit to mitigate any issues.

Essentially, if your lender believes you arent using the card enough, youre going overboard or youre using it irresponsibly, they can reduce your credit limit. They dont necessarily have to let you know, thoughtheyre only required to notify you if your limit is cut due to a missed payment, if you make only minimum payments on a high balance or if you show another red flag, according to the Fair Credit Reporting Act.

When it comes to avoiding a credit limit reduction and keeping your credit health in top shape, its best to review your credit report regularly to spot any changes and make payments on time, ideally above the minimum amount. To learn more about credit and credit repair services, reach out to our team of credit advisors.