Multiple Credit Checks: The Bottom Line

Multiple credit checks are just not a good idea, especially if your credit rating is already lower than youd like. However, now that you know about the problem you should be able to avoid applying for multiple credit lines and make alternative arrangements instead.

Getting credit can be a great and responsible way to get goods or services that you need, but your ability to get credit depends on a good credit score. That means that your priority has to be keeping your credit score as high as possible so that you can borrow when necessary!

Brandon Ackroyd

In house mobile phone expert at TigerMobiles.com. I head up our help and advice section answering customer questions and queries to help them make better buying decisions. I specialise in cybersecurity, smartphone tech and related tech products, authoring some of our buying guides and contributing to the wider technology community.

How Often Does A Credit Score Change

Since the score is a living record of a persons financial history, it can change on a daily basis. Typically, your credit score will be updated as new payments, account balance changes, new credit inquiries, or fluctuations in your outstanding debt take place. Though small changes in your credit score dont matter much, its important to monitor your score for major changes. Unanticipated things like identity theft can damage your score.

A Dispute Wont Always Remove Hard Inquiries

A negative item will only be removed from your credit report if you file the dispute and the credit bureau or data furnisher finds that the item was indeed incorrect, outdated or the organization cant verify the item.

Since an inquiry is a record of when someone checked your account, not when you opened a new account, a hard inquiry from a declined application isnt an error and you may not be able to successfully dispute it.

You may also find multiple hard inquiries for an auto loan or mortgage on your reports if you recently applied for an auto loan or mortgage with a dealership or broker. Its not uncommon for a dealer or broker to submit multiple applications for you in an attempt to find a loan with the lowest interest rate and best terms. These may be valid, and you dont need to worry too much about these, as theyll generally occur with the dedupe window.

In some cases, you may see a hard inquiry from a financial organization you dont recognize, but that may not be an error either. The company you apply for credit might have a parent company, or a different associated company, that funds the account and checks applicants credit.

You May Like: What Is Erc On My Credit Report

It Increases Your Debt

When you take out a personal loan, you add to the amount of debt you owe. This may ding your credit score if the new loan has a high balance and if you have other high balances on other credit accounts. Since your debt-to-available credit ratio makes up a good chunk of your FICO credit score, paying down the amount you owe can help to boost your score over time.

Strategically Shop For New Credit

You can use the credit-scoring rate shopping windows to apply for student loans, auto loans or mortgages with multiple lenders without increasing the impact of the hard inquiries. This is often a good idea, as you can compare rates and terms, and determine which lender will give you the best offer.

Newer FICO scores will count multiple hard inquiries for these types of loans that occur within a 45-day window as one inquiry. Older FICO models, which are still used in the mortgage industry, dedupe inquiries that occurred within a 14-day window. VantageScore also uses a 14-day dedupe, which it applies to all inquiries.

One way to limit the number of hard inquiries in your credit reports is to only apply for new credit accounts or credit line increases when you really need them. You may also want to spread out applications, particularly credit card applications that may not be subject to the dedupe rules.

Also Check: How To Get Medical Bills Off Credit Report

Treatment Of Multiple Credit Checks

Unrelated inquiries are counted separately for credit scoring proposes. However, if youre applying for a car loan, student loan or mortgage, it’s normal to shop around for the best deals. The credit scoring algorithm takes this into account, and typically, all related inquiries that occur within a certain period of time are treated as just one inquiry. Depending on which version of the FICO scoring model is used, this period ranges from between 14 and 45 days. For example, say youre going to buy a house. If you apply for five mortgages in a one-week period, all five inquiries count as just one for credit scoring purposes, which helps your credit score. However, if you applied for five credit cards in a one-week period, each inquiry would be counted separately.

What To Do Before An Inquiry

Before you apply for any loan or a line of credit, ask the lender whether the credit check needed for approval will be a hard or soft inquiry. This will help you preemptively determine the effect on your credit score. Try keeping hard enquiries to a minimum as it could severely affect your score. However, some credit rating agencies can view multiple hard checks as rate shopping which could be grouped into one single hard credit check.

The best way to prepare for loan and credit applications is to make sure your credit score can handle the short-term decrease once a hard credit check is done. Soft checks can be done by yourself to keep track of your own credit report and can be useful to help you prepare too.

Don’t Miss: How Long Is A Closed Account On Your Credit Report

How A Hard Inquiry Impacts Your Credit Score

If a hard inquiry affects your credit score, it can drop up to 10 points. But some hard inquiries could take away less than 10 points off of your score.

FICO score contemplates hard inquiries made in the last 12 months when they calculate your credit score. Be mindful that hard inquiries stay on your credit report for two years.

An Inquiry On One Report Wont Influence Credit Scores Based On Other Reports

A credit score depends on the information in one of your credit reports, but it isnt affected by your credit reports from the other two bureaus. Although major lenders often report your accounts and payments to all three credit bureaus, a creditor may only check one of your credit reports before making a lending decision.

As a result, a hard credit inquiry could show up on one of your reports, but not the others. When thats the case, it will only potentially impact credit scores that are based on the report that has the inquiry.

Also Check: A Credit Score Is Based In Part On

The Difference Between Hard And Soft Inquiries

Since checking your own credit score is a soft inquiry that doesnt ding your rating, its important to know what constitutes a hard inquiry and how a hard inquiry affects your score. Hard inquiries, which are also commonly referred to as hard pulls, occur when a financial institution pulls your entire to determine whether youre a good candidate as a borrower. This kind of action can result in a small reduction in your credit score that affects your rating for a few months, though the existence of a hard pull will hang around for approximately two years.

How To Get Hard Inquiries To Fall Off Your Credit Report

This is a common question, so we wanted to make sure to cover it here.

Keep in mind that you cant take hard credit inquiries off of your credit report if they were authorized by you.

Despite this, considering a hard inquiry drops off of your credit report after just 2 years and depending on how immediate your goals are allowing a hard inquiry to fall off your credit report may be the ideal option anyway.

However, theres one exception: if you notice a hard inquiry on your account that you did not authorize.

You May Like: How To Remove Negative Off Credit Report

Recommended Reading: Can You Get Late Payments Removed From Credit Report

New Credit Inquiries Can Raise Red Flags For Lenders

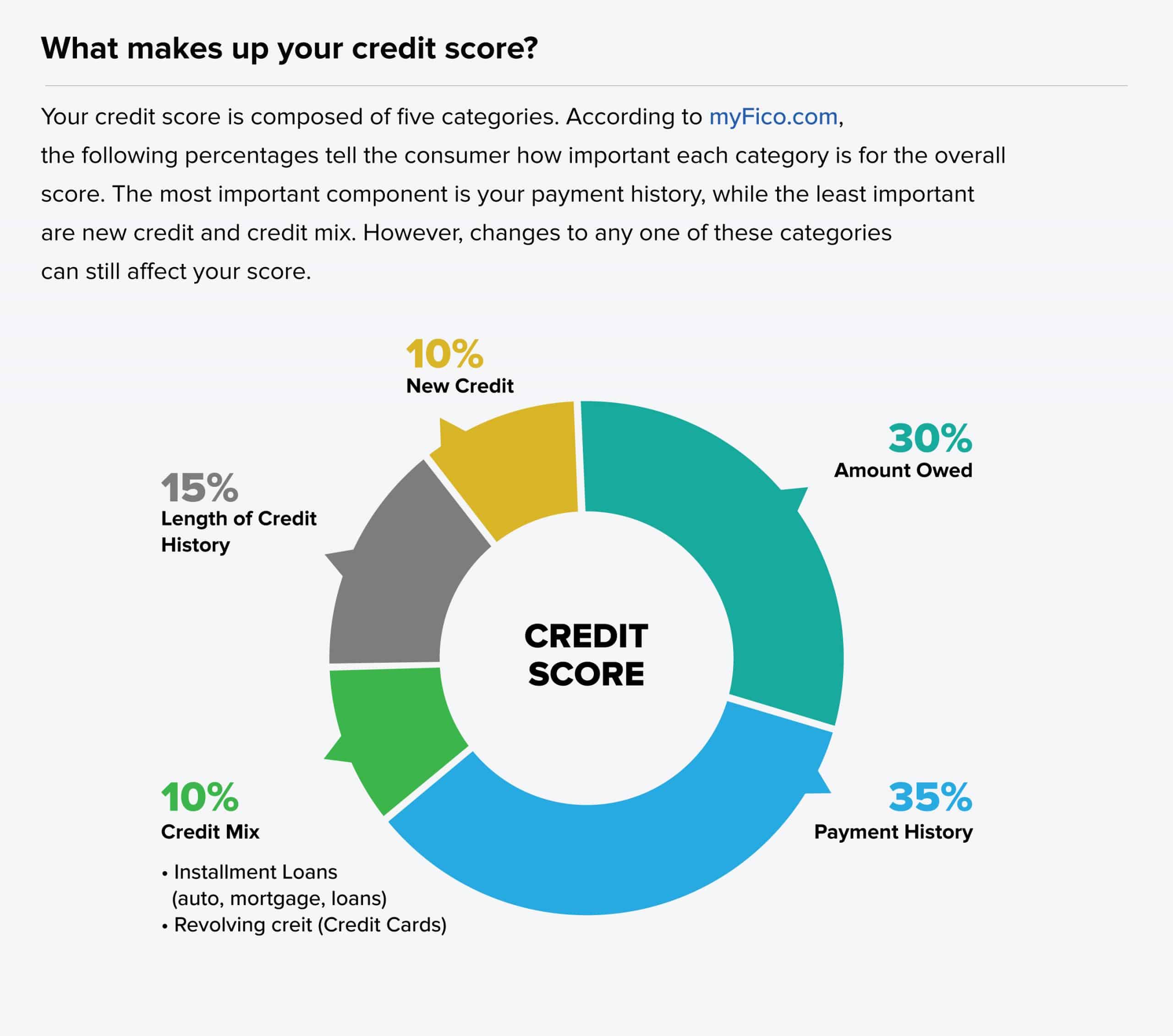

What creditors like to see are consumers who pay their bills on time. They also like to see low credit usage relative to your credit limits . These two areas payment history and credit utilization make up 65% of a persons credit score.

The remaining 35% is the length of credit history at 15%, credit mix at 10%, and finally new credit at 10%. Why should the 10% from new credit and inquiries make that much difference to a would-be creditor?

Its because a hard inquiry injects an amount of uncertainty in your file. Why did you apply for new credit? Are you going to max out the new credit line? Is the new credit a sign of instability? These are all potential red flags for a lender.

When the credit scoring elves at FICO and VantageScore look at this new activity on your file, their historical algorithms tell them that a certain percentage of people really do max out their new lines and some even go into default in a year or two. So, until you demonstrate that you are a still wise credit user, your score declines. This drop is more pronounced in a file with less credit history.

This is especially true if several inquiries are made in a relatively short period of time. If a creditor sees a bunch of new accounts in a potential customers credit report, alarm bells are going to sound.

Verificaciones De Crdito Suaves Comunes

- Verificar su puntaje de crédito en Credit Karma

- Ofertas de tarjetas de crédito precalificadas

- Cotizaciones de seguros precalificadas

- Verificación de empleo

Tenga en cuenta que existen otros tipos de verificaciones de crédito que podrían aparecer como una consulta dura o suave. Por ejemplo, los proveedores de servicios públicos, cable, internet y telefonía celular a menudo verifican su crédito.

Si no está seguro de cómo se clasificará una consulta en particular, pregunte a la empresa, al emisor de la tarjeta de crédito o la institución financiera involucrada para distinguir si se trata de una verificación de crédito dura o suave.

Read Also: Does Geico Use Credit Score

How To Minimize The Effect Of Hard Credit Inquiries

When youre buying a home or car, dont let a fear of racking up multiple hard inquiries stop you from shopping for the lowest interest rates.

FICO gives you a 30-day grace period before certain loan inquiries, like those for mortgage or auto, are reflected in your FICO® credit scores. And FICO may record multiple inquires for the same type of loans as a single inquiry as long as theyre made within a certain window. This window is typically about 14 days.

While some lenders can rely on scoring models that give you more time to shop without incurring an additional hard inquiry, you may want to stick to 14 days to do your comparison shopping, since you likely wont know which scoring model a lender relies on to generate your score.

How Do Hard Credit Inquiries Affect Your Credit Score

When you let a bank or lender do a hard credit check on your credit report, what does that mean for that all-important, three-digit numberâa.k.a your credit score?

And how long do hard inquiries stay on your credit report? Are you permanently branded a credit-checker?

Hereâs what you need to know:

When a lender hard pulls your credit, your credit score will take a small hit regardless of whether youâve been approved or declined. According to FICO, credit inquiries tend to correlate with higher risk borrowersâand your credit score will reflect that correlation.

Why do credit inquiries correlate with riskier borrowers?

Itâs hard to pay off debt. And as you open more and more new credit accounts , it becomes less and less likely that youâll be able to pay off each and every one of your existing credit accounts. And because a credit inquiry comes along with each new credit account you open, credit inquiries are the signal that indicate youâre opening a lot of new accounts.

Back to the issue credit inquiries staying on your credit report.

All in, donât worryâcredit inquiries donât impact your credit score that much.

So, if thereâs a credit inquiry thatâs on your credit report, donât panicâit doesnât have a huge impact on your credit score. According to Tina Hay, CEO of Napkin Finance, âA hard credit pull can take off several points from your credit score, but itâs typically a 1 to 5 point impact.â

Recommended Reading: Does Affirm Go On Your Credit Report

Recommended Reading: When Does Discover Report Credit Utilization

Why Applying For A New Credit Card Can Hurt Your Score

So, why can a hard inquiry actually hurt your credit? Hard inquiries are meant to keep track of how many loans or lines of credit you are applying for. If you try to take out a large number of loans or credit cards, youll become a riskier borrower and will become less likely to pay off your loans.

Banks and lenders like to know these details ahead of time so that they can assess how risky of a borrower you are. They also like to know how many loans or credit cards youve applied for in the past. Thats why they use hard inquiries whenever you are being assessed for the riskiness of a loan, and thats why multiple hard inquiries can hurt your credit score.

What Is A Soft Credit Check

A soft check or a soft inquiry occurs when you check your own credit report or when a credit card issuer/ financial institution checks your credit score without your prior permission just to see if you qualify for any pre-existing offers.

For instance, if you see any pre-approved loan offers available to you by your bank, they are evaluated by conducting a soft check to see your credit score and recent credit history.

Unlike hard checks, soft checks do not affect your credit score in any way. Since the soft checks are not connected to a specific application for a new line of credit, they are only visible to you when you view your credit reports.

You May Like: Does Closing A Credit Card Hurt Your Credit Rating

The Central Credit Register

The Central Credit Register provides credit reports to borrowers andlenders. It is a database that stores personal and credit information on loansof 500 or more. It is operated by the Central Bank of Ireland.

The Central Credit Register started to record loans from 30 June 2017. Itkeeps a record for 5 years after the last payment for a loan is made.

The Central Credit Register does not decide whether you get a loan. Lendersuse the credit report to assess your loan application before making a decision.They may also take into consideration your income and expenses, such as rentand utilities. Different lenders have different criteria for approving loans.

Do Mortgage Quotes Affect Credit Scores

- You can request free mortgage quotes from lenders without them pulling credit

- This will have absolutely no effect on your credit scores since youre only giving them a verbal estimate

- They may tell you that your credit scores could differ but its a perfectly fine starting point

- Once youve gathered several quotes you can take things a step further and let them run your credit if you wish to move forward

Weve discussed mortgage inquiries, but what about simple mortgage quotes?

Well, as long as the lender doesnt actually pull your credit, or uses a service that only results in a soft inquiry, it wont affect your credit in the slightest.

Assuming youre just calling around and comparing rates from lender to lender, or broker to broker, your credit will remain untouched.

Theres nothing wrong with just giving these folks a ballpark FICO score and seeing what rates they quote you.

Sure, your actual credit scores may fluctuate if and when you apply, but its pretty easy to check your credit for free these days and use that as an estimate.

Your actual scores shouldnt be too different since these free services come straight from the credit bureaus, so this is a fine alternative to shop without letting lenders dig into your actual credit report and scores.

Once you have a better idea of which mortgage lender you want to move forward with, you can let them pull your actual credit report and lock in pricing.

Read Also: What Does A Fixed Rate Mortgage Mean

You May Like: How Long Do Credit Cards Stay On Your Credit Report

How Multiple Credit Checks For Rentals Affect Your Credit Score

If youre looking at a number of apartments to find one that meets your needs and your budget, several landlords may pull your credit report or check your credit score. But this isnt as damaging to your credit report as it might sound.

According to FICO, its scoring model allows for rate-shopping for consumers applying for a loan or, in this case, apartment-hunting for people seeking a place to live. FICO ignores inquiries made within 30 days of your apartment application. So, as long as your apartment hunt doesnt drag on for too long, your score wont be hurt by multiple credit inquiries.

The VantageScore credit scoring model only permits 14 days of rate shopping, but considers all inquiries made within that time as a single inquiry, regardless of the type of credit application. So, if you are trying to get a mortgage, cant find a suitable rate, and decide to rent instead, the hard pulls from your mortgage applications and tenant applications will all count as a single inquiry.

Rental denials do not show up on your credit report. If a landlord denies housing to a tenant or charges higher rent due to information in their credit report, the landlord must disclose how they obtained that information. The prospective tenant is then entitled to a free credit report.