Whats A Credit Report

A credit report includes information about your past and existing credit agreements, such as credit card accounts, mortgages, and student loans, and lists inquiries about your credit history. It outlines how much you owe creditors, how long each account has been open, and how consistently you make on-time payments. Credit reports also list related public records, such as collections or bankruptcy filings.

Why Is My Fico Credit Score Different Than Other Credit Scores Ive Seen

The score Discover provides may be different than other scores you see for several reasons:

What Is The Difference Between Fico Vs Vantage Scores

One way the two main credit score models differ is through the method each uses to pull your credit history.

A FICO credit score is determined by a snapshot of all the available credit history data when your score was generated. A VantageScore focuses more on your credit history and informs lenders of your credit behavior.

Both types of credit scores use a variety of similar factors to create your credit score. However, the defining difference is how much these factors influence your score. While both scores look at your credit history to examine your credit usages, balances, payment history, and inquiries, each score is influenced differently by each factor.

Don’t Miss: What Happens When You Report Fraud On Your Credit Card

How To Check Your Fico Score

Knowing your FICO Score can help you get a handle on your finances and prepare you for the loan or credit card application process. Luckily, there are a number of ways to check your credit score. Start by reviewing your credit card statements and card providers website. Many issuers offer customers free FICO scores each month, while others even offer the service to non-cardholders.

Alternatively, you can visit FICOs website and choose from one of three monthly plans that provide access to FICO scores, credit reports, identity monitoring and other services.

Why Is Fico Score Lower Than Transunion

This is mainly because of two reasons: For one, lenders may pull your credit from different credit bureaus, whether it is Experian, Equifax or TransUnion. Your score can then differ based on what bureau your credit report is pulled from since they don’t all receive the same information about your credit accounts.

Don’t Miss: Does Increasing Credit Limit Hurt Score

Why Can I See My Fico Score But Others On My Account Cant See Theirs

You can see your FICO® Score because you are the primary account holder of an eligible account.

Others may not be able to view their scores if:

- They recently opened a new account

- Theyre an authorized user on someone elses account

- They have a billing statement in someone elses name

- They do not have an eligible account in Wells Fargo Online®

Recommended Reading: Does Klarna Report To Credit

Why You Should Never Put Money Down On A Lease

Putting money down on a car lease isn’t typically required unless you have bad credit. If you aren’t required to make a down payment on a lease, you generally shouldn’t. … This is because all of the interest charges are computed into the lease price up front, so the total cost of a lease is set ahead of time.

Don’t Miss: How To Check Business Credit Score

Where To Get Your Fico Score For Free

There are a variety of ways to check your credit score for free, for both the FICO Score and the VantageScore. For example, LendingTree offers a free VantageScore, along with credit monitoring.

If you have a bank account or credit card account with Bank of America, Barclays, Citibank, Discover, PNC Bank or Wells Fargo, to name a few, they all grant customers access to your FICO Score via their online portals.

Even if youre not a customer of Capital One, the issuer offers a free online VantageScore that is updated every 30 days through its .

If Youve Applied For A Credit Card Auto Loan Mortgage Or Some Other Form Of Credit Odds Are Youve Heard The Phrase Fico Score

When you apply for credit, potential creditors may want to gauge how likely you are to pay your bills on time. Many creditors use FICO® credit scores to assess applicants, manage accounts, and determine rates and terms.

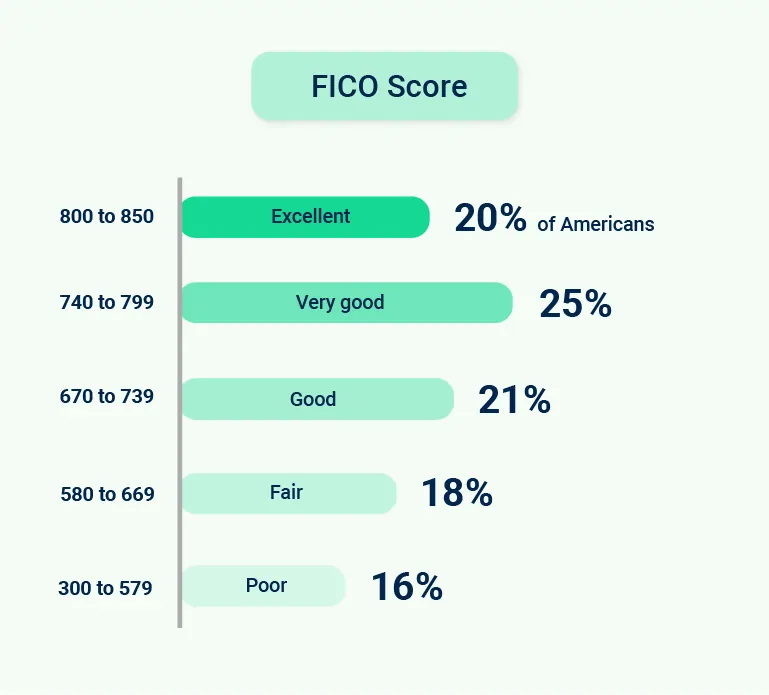

A FICO® score is a three-digit number ranging from 300 to 850 . These scores are largely based on your and can help creditors assess how likely you are to repay debt.

Fair Isaac Corporation, or FICO, introduced the first credit risk score in 1981. The organizations reputation as one of the primary credit-rating companies in the U.S. has grown since then, reaching different industries with scores geared toward different credit products.

Even though you may hear FICO score and think of it as a single credit score, you can actually have several of FICO scores, which can differ by industry. Read on to learn more.

Also Check: Is 686 A Good Credit Score

Why Is My Fico Score Lower Than My Credit Score

Because each of the three credit reporting bureaus doesnt always have the same information, you could see a difference at each bureau depending on when you access your score. That means your FICO score could show lower than a VantageScore or other credit scoring option that is pulling slightly different information.

Check Your Fico Score For Free

While there are newer FICO® Score versions available, FICO® Score 8 remains one of the most widely used versions. Partially, this is because lenders need to invest time and money into switching to a new scoring model. You can check your FICO® Score 8 based on your Experian credit report for free online. You’ll also learn about which factors are most helping or hurting your scores and can track your score over time.

Read Also: How To Raise Your Credit Score Quickly

Which Credit Score Will A Lender Check When You Apply For A Loan

Although VantageScore credit scores have been around for about 15 years, the FICO Score is still the preferred choice of most lenders. In the U.S., lenders use FICO Scores in 90% of lending decisions. If you apply for a loan, credit card or some other type of financing, the lender will probably check your FICO Score when it reviews your application.

But that doesnt mean you should ignore VantageScore brand credit scores. It doesnt mean VantageScore credit scores are fake either, as some may claim.

Nine out of the 10 biggest banks in the U.S use VantageScore credit scores for some purpose. Plus, lenders and consumers used some 12.3 billion VantageScore credit scores in a 12 month period between 2018 and 2019.

Understanding How A Fico Credit Score Is Determined

This video from the Continuing Feducation series provides a short overview of credit scoreshow they are determined and why they are important.

This video is included in an online booklet for Boy Scouts to earn the Personal Management merit badge, one of the requirements to become an Eagle Scout. Learn more about the badge and other videos featured in the booklet »

Also Check: Do Closed Credit Cards Affect Credit Score

Can I Repair My Credit When I Have Too Much Debt

If you are struggling with debt, its crucial to get that under control before focusing on your credit score. Debt relief methods like debt consolidation and settlement can help you reorganize and pay down your debt faster. As your debt decreases, your creditworthiness will improve. Then you can focus on building your credit score through healthy habits to achieve your financial goals.

Multiple Bureaus Multiple Scores

Its possible for a lender to pull a FICO score based on only one of the 3 major credit bureaus. That means your FICO score could be different from one lender to another based on which credit report the score was based on. If your Equifax-based score is worse than your TransUnion-based score, one lender might approve your loan application while another might deny you. With VantageScores, there is more uniformity across all three bureaus, so the score doesnt tend to vary from lender to lender.

Don’t Miss: Is 850 A Good Credit Score

Do Banks Look At Fico Score Or Credit Score

For the majority of general lending decisions, such as personal loans and credit cards, lenders use your FICO Score. Your FICO Score is calculated by the data analytics company Fair Isaac Corporation, and it’s based on data from your credit reports. VantageScore, another scoring model, is a well-known alternative.

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you\’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Don’t Miss: How To Establish A Credit Report

Fico Score Vs Credit Score: Are They The Same Thing

If youre trying to get a handle on your financial life, then youve probably heard about credit score, FICO score, credit mix, and definitely credit debt. We get it a lot is going on there. Today, lets focus on your FICO score.

Is your FICO score the same as your credit score? Yes! At least, in a way, it is. When it comes to FICO score vs. credit score, theres actually no versus here at all. Your FICO score is one of your credit scores, along with your VantageScore 3.0.

Still confused? Well explain.

Why Your Credit Karma Credit Score Differs

There are multiple reasons why your credit score differs between what a personal finance website tells you and what your credit card company or a prospective lender find.

This is mainly because of two reasons: For one, lenders may pull your credit from different , whether it is Experian, Equifax or TransUnion. Your score can then differ based on what bureau your t is pulled from since they don’t all receive the same information about your credit accounts. Secondly, different credit score models exist across the board.

As it states on its website, Credit Karma uses the VantageScore® 3.0 model. VantageScore may look at the same factors that the other popular FICO scoring model does, such as your payment history, your amounts owed, your length of credit history, your new credit and your credit mix, but each scoring model weighs these factors differently.

For this reason, VantageScore and FICO Scores tend to vary from one another. Your VantageScore® 3.0 on Credit Karma will likely be different from your FICO Score that lenders often use.

If you plan on applying for credit, make sure to check your FICO Score since there’s a good chance lenders will use it to determine your creditworthiness. FICO Scores are used in over 90% of U.S. lending decisions.

*Results may vary. Some may not see improved scores or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost.

Editorial Note:

Also Check: What Is Erc On My Credit Report

Whats In My Credit Reports

Your are records of your past dealings with creditors and other credit history. They include information such as your name, addresses, employers, the history and status of various credit accounts, and inquiries from companies checking your reports. If applicable, youll also find information from public records, such as bankruptcies, tax liens and civil judgments.

Who And What Is Fico

Fair Isaac Corporation is the company that develops and maintains the mathematical formula to calculate FICO® Scores. FICO calculates your FICO Scores using information kept at the credit bureaus.

This leads to 2 important takeaways:

This should help clear up the fact that although FICO works with the credit bureaus, it is not actually a credit bureau .

Read Also: Where Does Your Credit Score Start

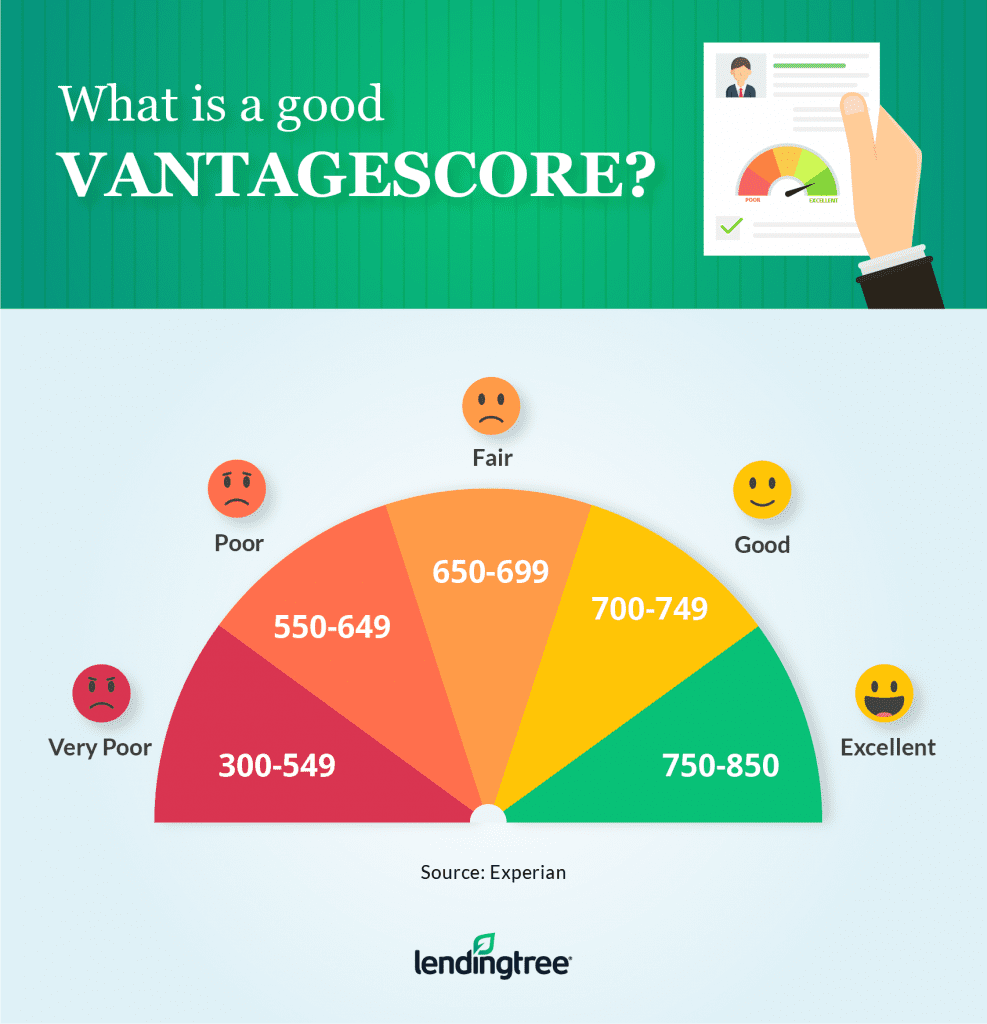

Vantagescore Is An Alternative To Fico

Another scoring model called VantageScore is a well-known alternative to the FICO model but still isnt as popular or widely used. As a competitive alternative to FICO, the VantageScore was developed by three major credit bureaus, Experian, Equifax, and TransUnion.

In 2006 the bureaus jointly funded the development of the VantageScore brand. They profit from the development of this scoring system and its use by other reporting agencies but still use versions of the FICO model for their credit reports.

Notably, all three credit bureaus use versions created by FICO to work with each credit bureaus credit reports. There are many different versions of the FICO scoring model for different types of credit pulls. FICO 8 is the most common.

What Is A Fico Score

FICO® is more than just a credit scorein fact, its a whole company. FICO® stands for Fair Isaac Corporation, which is a data analytics firm that focuses on providing credit scoring services to lenders who need to vet potential borrowers. To date, the FICO® score is the most-used credit score model in the United States.

The goal of your FICO® score is to rank consumers based on how likely they are to pay their debts. They do this by calculating your risk according to factors like your credit mix, credit limit use, and the length of your credit history. Then, they compile the results into a three-digit credit score, known as the FICO® score.

Recommended Reading: What Is A Public Record Credit Report

Why Is My Fico Score Different Than Other Scores Ive Seen

There are many different types of credit scores available to consumers and lenders. FICO® Scores are the credit scores used by most lenders, but different lenders may use different versions of FICO® Scores and some lenders may use different versions of FICO® Scores for different credit products, as discussed more fully here.

Additionally, FICO® Scores are based on credit report data from a particular consumer reporting agency, so differences in your credit reports between credit reporting agencies may create differences in your FICO® Scores. The FICO® Score being made available to you through this service is the score provided by TransUnion. Scores provided by Experian and/or Equifax will likely vary due to differences in the customers credit reports with those credit reporting agencies. When reviewing a score, take note of the score date, consumer reporting agency that provided the credit report for the score, and score type.

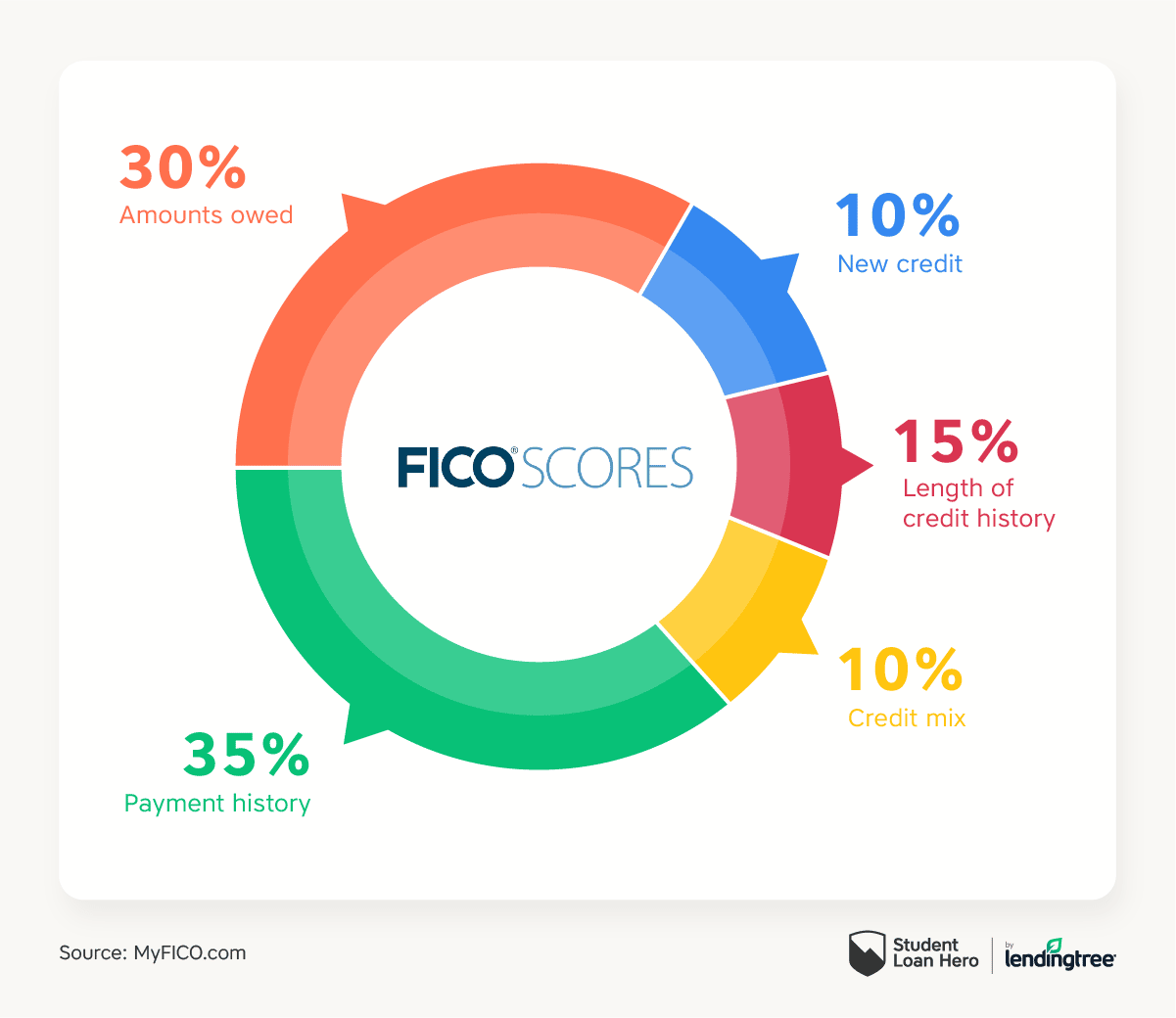

What Factors Contribute To The Fico Credit Score

Most credit rating companies use five main factors to build their credit score, each having a different level of impact. Here are the factors and their weights for the FICO Classic Credit Score®:

-

Payment history .

What it looks at: Especially within the past two years, but up to the past seven years, how often do you meet your credit payments on time and in full?

What it means: If lenders see a strong history of positive payments, they are more likely to see you as a trustworthy borrower.

-

Amounts owed .

What it looks at: What is your credit utilization rate? Divide the total amount of credit you have been given by the total amount you currently owe.

What it means: When your credit utilization rate is less than 30%, you are seen as a responsible manager of credit.

-

Length of credit history .

What it looks at: What’s the average age of your credit lines?

What it means: When lenders see a long average age, they can be confident that you have strong relationships with your creditors.

-

What it looks at: How many different lines of credit are currently open in your name?

What it means: When lenders see a diverse mix of credit, they can feel confident that you are good at managing your credit lines.

-

New credit .

What it looks at: How often are credit checks made for your credit score to open new lines of credit?

What it means: When lenders see many new credit inquiries, they assign a higher level of risk to the borrower.

You May Like: What Is Considered A Good Credit Score